Medical Welfare Program

Network vs. Non-Network Providers

BCBSTX negotiates with doctors, hospitals and other providers to charge less for services received in-network. When you choose a provider who is “in-network,” it means you will pay less out of pocket. Different options are available to you depending on where you live.

PPO A or PPO B: If you see a non-network provider, you will pay a higher coinsurance percentage and will have a higher out-of-pocket maximum. You may also be responsible for additional costs if your provider charges more than similar providers in your area (called the Reasonable & Customary limit).

EPO: You will pay the full cost for non-network services.

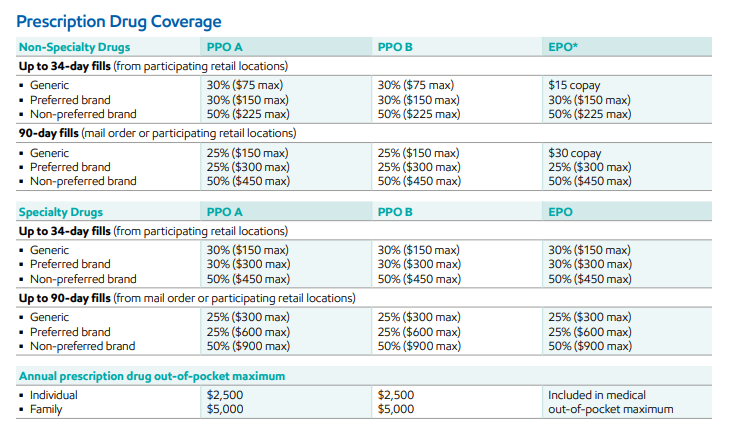

Compare coverage for services under the three medical options available.

Which medical option should you choose? It depends on your health care needs and your personal preferences. No matter what you’re looking for, we’ve got you covered with a range of options to fit your situation. As you decide, consider what matters most to you. You can also compare all three of your medical options in the Your Total Rewards portal when making your Annual Enrollment elections.

Would you rather pay more in contributions OR more when you need care?

If you prefer to pay less when you need care, consider the EPO option with no deductible and lower copays. Keep in mind, you’ll pay higher contributions out of your paycheck. If you don’t have many health care needs, this option may end up costing you more.

If you prefer to pay lower contributions from your paycheck, you should consider the PPO options. These options offer lower monthly contributions, but the deductibles and copays are higher, which means you will pay more when you get care.

Are you comfortable getting all of your care from network providers?

The EPO requires you to use only network providers for care. It has an extensive network of providers and facilities, so if you see a non-network doctor or use a non-network facility, you will pay 100% of the cost if you select the EPO option. We strongly recommend you work with a primary care physician (PCP) to coordinate your care.

Have you reached your annual out-of-pocket maximum during the last two years?

The annual out-of-pocket maximum is an important consideration if you’ve had extensive health care claims the last two years or expect high claims in the future. The plan pays for 100% of eligible health care expenses after you reach the out-of-pocket maximum in a plan year.

The EPO, which is the network only option, has a lower out-of-pocket maximum than the PPO options.

Protection From Surprise Billing

When you get emergency care or get treated by a non-network provider at a network hospital or facility or receive non-network air ambulance services, you are now protected from “surprise billing.” What is surprise billing? It’s what happens when you receive an unexpected bill or charge from a provider who you have no control over, such as an anesthesiologist or radiologist at an in-network facility. Your plan will treat this as an in-network charge, which reduces your financial exposure. Learn more at exxonmobilfamily.com/en/annual-enrollment/legal-notices.

Important Savings Reminder

If you earned the Culture of Health (CoH) rate by fulfilling the requirements in 2025, you will receive a reduction in your monthly medical contributions in 2026:

- $30/month for participant only coverage

- $60/month for participant + spouse

- $60/month for participant + child(ren) coverage

- $90/month for family coverage

Annual deductible: The amount you must pay each calendar year before the Plan begins to pay for covered health care expenses you incur.

Annual out-of-pocket maximum: The most you have to pay for medical and behavioral health services in a calendar year; includes the deductible, coinsurance and copays but does not include monthly contributions.

Coinsurance: Your financial responsibility (percentage of the cost) after the deductible has been met

Copay: A fixed amount you pay at the time of service, in which you do not have to meet the deductible first

Network providers: A provider, facility or hospital that has negotiated with BCBSTX to belong to their network. Network providers charge less for their services because of those negotiated rates.

Non-network providers: Doctors or facilities who do not have a contract with BCBSTX to belong to their network. Using non-network providers will result in higher costs for you.

Preventive care: Care typically covered at no cost to you, and includes services like annual health exams, immunizations, early warning screenings and certain medications.

Surprise billing: When you get emergency care or get treated by a non-network provider at a network hospital or facility, you are now protected from “surprise billing.” Surprise billing is when you receive an unexpected bill or charge from a provider who you have no control over, such as an anesthesiologist or radiologist at an in-network facility. Your plan will treat this as a network charge, which reduces your financial exposure.