Investment considerations

Q. Which investments are best for me?

A. The answer depends on your investment objective and risk tolerance. All investments involve some risk. Failure to make an investment decision can be risky, too. For example, inflation will erode the purchasing power of your savings. By understanding the potential risks and returns for each of the Savings Plan’s investment options – and what your own short-term and long-term investment goals are – you can begin to make important investment decisions that will be right for you.

Answering the questions below will help you make decisions about which Savings Plan investment options to choose:

- How conservative or aggressive an investor are you? Are you comfortable holding riskier assets, which may fluctuate more in the short term, to try to achieve higher long-term returns? Would you rather try to minimize short term risk?

- What is your investment time horizon? Are you just beginning to save for retirement or are you nearing retirement now?

- Do you want to diversify your investments to minimize the potential risk associated with any one investment option?

All of the investment options in the Savings Plan entail some risk – the value of your assets can decline. Remember that past performance of any investment option is not a guarantee, nor is it necessarily indicative, of future returns.

Key investing concepts

Time horizon

If you have a longer investment time horizon (time until you need to use your money), you may be willing to tolerate a greater level of risk, typically associated with equity-based investments, in the expectation that you will have better investment results over the long run. But, if you have a shorter investment time horizon, year-to-year stability of returns associated with lower-risk investments such as fixed-income securities (e.g. Common Assets or Bond Units) may fit your needs better.

Diversification

To help achieve long-term retirement security, you should give careful consideration to the benefits of a well- balanced and diversified investment portfolio. Spreading your assets among different types of investments can help you achieve a favorable rate of return, while minimizing your overall risk of losing money. This is because market or other economic conditions that cause one category of assets, or one particular security, to perform very well often cause another asset category, or another particular security, to perform poorly. If you invest more than 20% of your retirement savings in any one company or industry, your savings may not be properly diversified. Your savings may not be properly diversified even if you have 20% or less of your retirement savings invested in one company or industry, including Exxon Mobil Corporation, depending on your particular circumstances. Although diversification is not a guarantee against loss, it is an effective strategy to help you manage investment risk. In deciding how to invest your retirement savings, you should take into account all of your assets, including any retirement savings outside of the Savings Plan. You should also consider, for example, that any S&P 500 indexed investment option, such as Equity Units, is very likely to invest in Exxon Mobil Corporation. No single approach is right for everyone because, among other factors, individuals have different financial goals, different time horizons for meeting their goals, and different tolerances for risk. It is also important to periodically review your investment portfolio, your investment objectives, and the investment options under the Savings Plan to help ensure that your retirement savings will meet your retirement goals.

Dollar cost averaging

You may wish to invest a regular amount on a periodic basis instead of investing one lump-sum amount. This tends to average out the cost of investing and avoids possibly making one investment at the most expensive point during a market cycle. This is known as "dollar cost averaging" and you do this automatically with payroll deductions for your contributions and the company match.

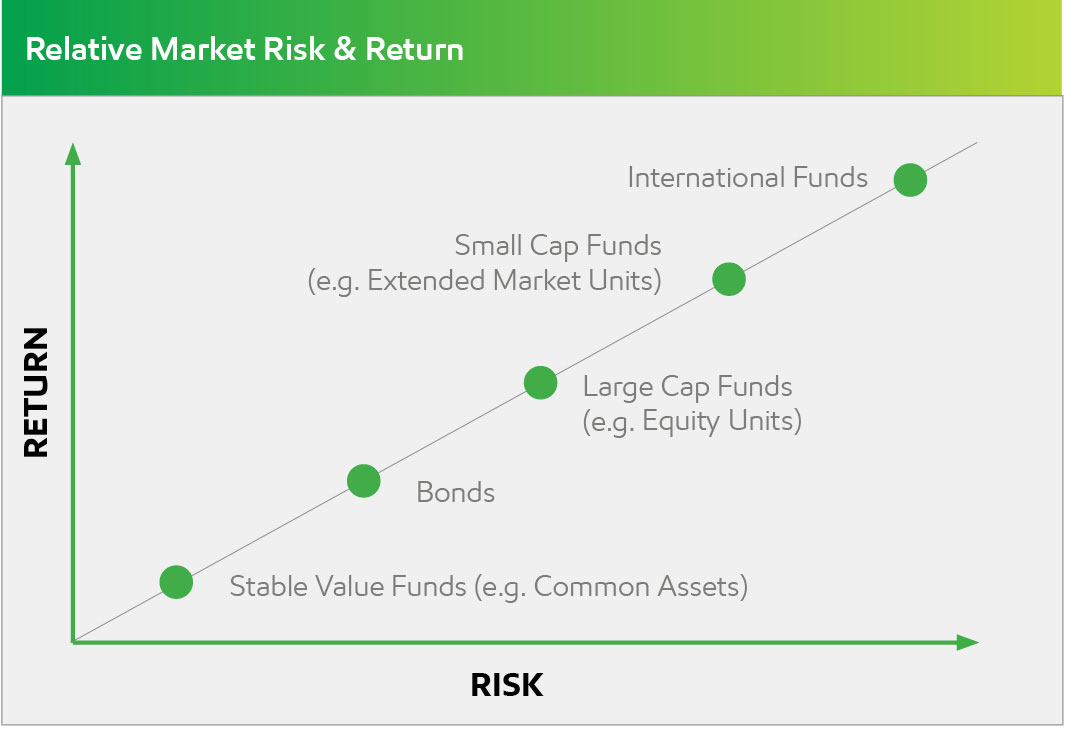

Market risk

This represents the potential for fluctuation in the amount of return on your investment or in the value of your investment. It is important to know that all of the investment options involve risk. While some investments have historically fluctuated more than others (i.e. they have a higher risk), you could lose money by investing in any of the funds. Generally, an investment with a higher expected rate of long-term return also will have a higher risk.

Discussion of specific investment considerations

The following points highlight some specific risks and investment considerations that apply to each investment option in the Savings Plan. While some investment options are generally considered more conservative (less risky) than others, all involve some degree of risk that your investment could lose value or that your rate of return could decline.

- Common Assets – Because the Common Assets fund is invested solely in short to medium term fixed- income securities, its return tends to fluctuate less widely than the returns on long term bonds or equity-based investments (see Equity-based Investment Options below for more information). Historically, Common Assets have not provided as high a level of return over longer periods as the other investment options. However, Common Assets have outperformed the equity-based investments during periods of declining stock market prices. Common Assets is a relatively conservative option for your portfolio based on risk and potential return.

- Bond Units – Bonds in this fund have a longer average maturity than securities in the Common Assets fund, so the returns on Bond Units generally will fluctuate more than those on the Common Assets fund, though generally less than those on equity-based investments.

- Equity-based Investment Options – Equity-based investments (i.e., stocks and funds composed primarily of stocks, such as Equity Units, Extended Market Units, International Equity Units and Balanced Fund Units) are subject to increased market risk. This is because common stock prices may decline significantly over short or even extended periods of time. Equity markets are volatile and cyclical. However, they have generally provided higher returns than either intermediate or long term government bonds over long periods of time.

- Equity Units and Extended Market Units – These investments represent interests in broadly diversified domestic stock funds. The return of the small- and mid-capitalization stocks in the Extended Market Units fund generally have fluctuated more than those of the large-capitalization stocks in the Equity Units fund.

- International Equity Units – This fund offers diversification outside the U.S. Its return may fluctuate independently of that of Equity Units or Extended Market Units and can be used to balance the risk of investing in U.S. stocks alone. Because this fund is subject to risk based on conditions in other parts of the world, including government actions and currency fluctuations, returns may vary more widely than those of Equity Units or Extended Market Units.

- Balanced Fund Units – This fund is the most broadly diversified investment option because each unit represents an investment in a combination of Equity Units, Extended Market Units, International Equity Units, and Bond Units. This diversification may result in less fluctuation of returns over time than those of other stock-based investment options individually. However, during periods of strong stock market returns, the Balanced Fund Units may have lower returns than those of the all-stock investment options.

- ExxonMobil Stock – With an investment in ExxonMobil stock, you have the potential risks and rewards of investing in a single stock. As a shareholder, the return on your investment depends on the performance of Exxon Mobil Corporation. It is therefore considered a non-diversified investment. Keep in mind that investing all your assets in any single stock typically carries higher risk than a more diversified portfolio of investments. See more on diversification in the section on Investment Considerations.

The Savings Plan website at http://xomsavings.voya.com and the Savings Plan Telephone Service (STS) at 877-966-4015 are available for account information and transactions.